The Real Costs of Not Having a Bank Account

For instance, the Federal Deposit Insurance Corporation (FDIC) reports that 5.4% of American households did not have a bank account in 2019, which translates to more than 7.1 million families since America has more than 325 million people.

Why is this happening to them? First, some people cannot afford to open and keep an account – they believe they do not have enough money for this. Second, there are those who are distrustful of banks due to high fees or untrustworthiness.

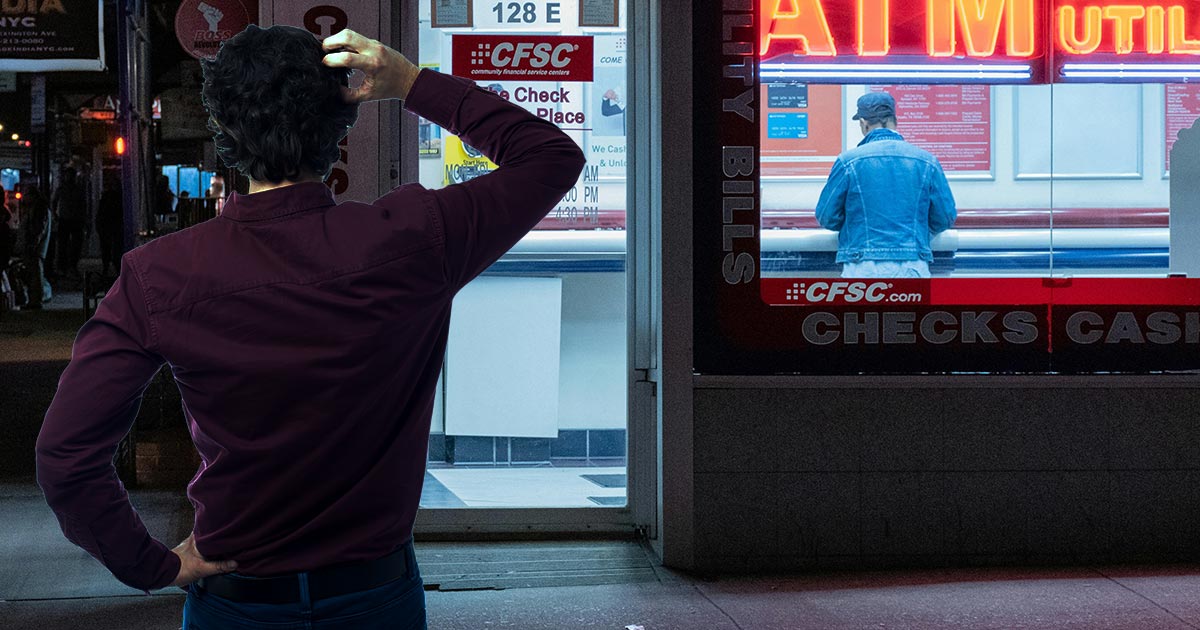

However, going without a bank account can be very costly. Here are examples of what may happen if you rely on non-traditional finance:

The Astronomical Cost of Cashing Checks:

It’s easy for someone with a checking account to deposit or cash checks without incurring any charges whatsoever; however, check-cashing services such as these often charge a proportionate fee on the full amount of the check itself that can sometimes go up to five percent in certain places. When all is said and done, these costs might compensate for keeping a banking account’s expenses back in future times.

Expenses for Money Orders:

Although supposedly, a university degree is bound to lead to a better future, it comes at a cost of debt. You may be required to purchase money orders for utility or rent payments if you don’t have a bank account. These usually go for between $1.15 and $1.55 each. Besides, this is more difficult and inconvenient now that we have COVID-19 pandemic.

Prepaid Cards with Higher Fees:

Prepaid cards also come with some costs such as activation fees, monthly maintenance fees, ATM withdrawal fees even though they are an alternative to carrying cash. Another thing is misplacing a prepaid card can be so hard or lead into potential financial loss.

Fewer Credit Card Options:

The majority of credit card companies require applicants to have bank accounts. However there are alternatives available for those who do not have them but these often lack the advantages present in ordinary cards.

There are Limited Saving Opportunities:

One’s ability to make significant savings is curtailed through cash-only or prepaid cards. As a result, without a secure place to keep their money, they may be tempted to spend all of it as soon as they receive it, thus living from hand to mouth.

To sum up, the banking industry still remains the most effective and inexpensive way of handling money despite some limitations. Individuals can beat the system by being conversant with regulations and charges emanating from bank accounts. Ultimately, disintegration of traditional banking services will result in higher prices and less personal control over one’s finances thereby undermining long term financial security.

Editor-in-Chief • Industry Trends Writer

Ethan analyzes market shifts and predicts future developments in different industries to keep his audience well informed and ready.