Internet Banking for Dummies

In this day and age, personal finance is a slippery journey. Nonetheless, the knowledge of how your money goes in and out of your account is very important. Thanks to the internet you can do it: online banking.

Most major banks today have online billing options that make managing your money much easier than ever before. Here are some few tips to get you started:

Online Banking:

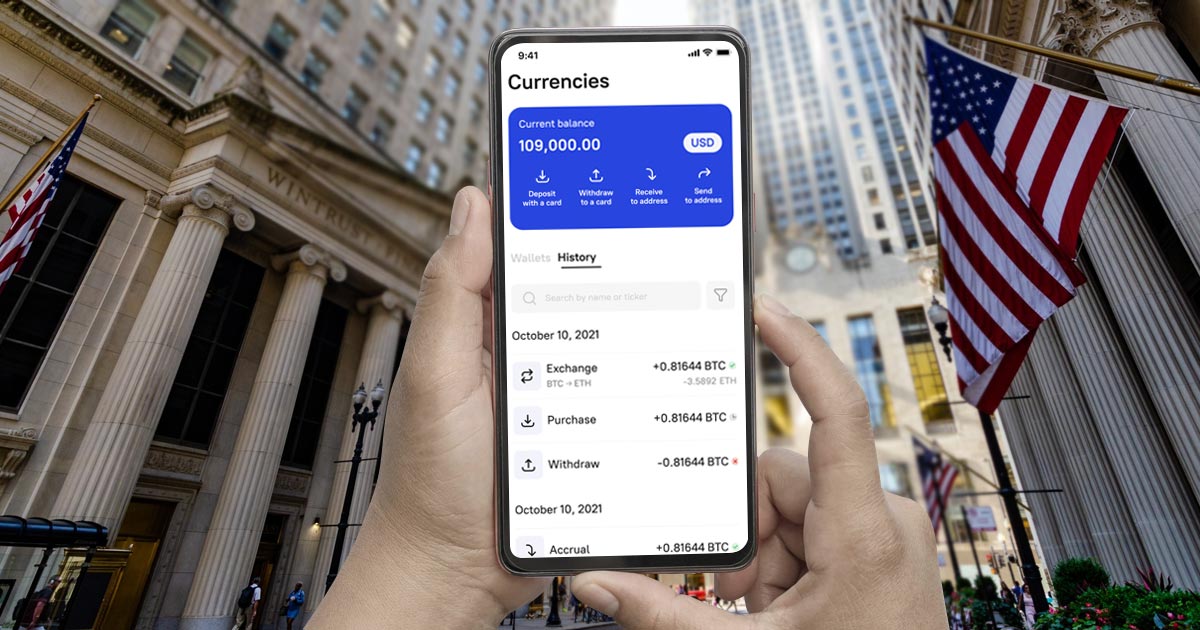

Think of internet banking like an electronic statement that lists all of your deposits and withdrawals for checking and savings accounts. You can usually access at least three months’ worth of statements with an option to obtain further detailed records from your banker. This useful tool enables you keep track on expenses, detect any fraudulent activity as well as understand more about your spending habit among others. Monthly paper statements are now available twenty four hours a day on web; forget about them. But if one wants paper copies then he/she can still ask for monthly hard copy statements.

Online Bill Payment:

Another benefit that can be derived from internet banking is that it allows customers to pay their own bills. This enables one to settle his/her payments in accordance with one’s own plans and choices. For example, you can establish a system for automatic payment of the recurring charges or personally make payment as soon as they arise. In addition, this program bundles up billing activities under one platform which means that your monthly expenses and billing cycles are all captured together in one shot. From such an analysis you can see where money is going and what has to come first.

While online bill payment may help you organize your finances, it also permits easy management of funds through internet banking.

Associate Editor • Technology News and Cybersecurity Specialist

Olivia provides detailed latest tech news, reviews of latest gadget trends, and compelling cybersecurity tips and tricks on the internet in todays world.