Getting approved for certain credit cards can be difficult. According to a recent Salary Finance research, 33 percent of Americans had credit denials in the past year alone. People with bad credit scores or a credit history that has been up and down may find it difficult to get approved for cards that have low benefits and credit limits.

Category: Credit

Top Credit Cards Designed for Pet Owners in Mind

Having a pet can be very satisfying, but it also comes with significant financial responsibilities. The cost of regular care and unexpected vet bills can add up fast. Luckily, pet owners can feel more secure about their money with the help of credit cards. Looking at the benefits and features of these cards can be very useful in urgent situations.

Five American Credit Cards with Low Interest Rates in 2024

Currently, there are many no-fee credit cards with low interest rates available on the market. You will get the actual interest rate depending on your credit history and score. Most cards come with introductory rewards that you should maximize before they expire.

Five Canadian Credit Cards with Cash Back and Low Interest Rates

Unmatched convenience is provided by credit cards, which make it easier to pay for everything from regular needs like coffee runs to unforeseen emergencies like auto repairs. Cash back credit cards are unique among credit card options because of their rewarding characteristics.

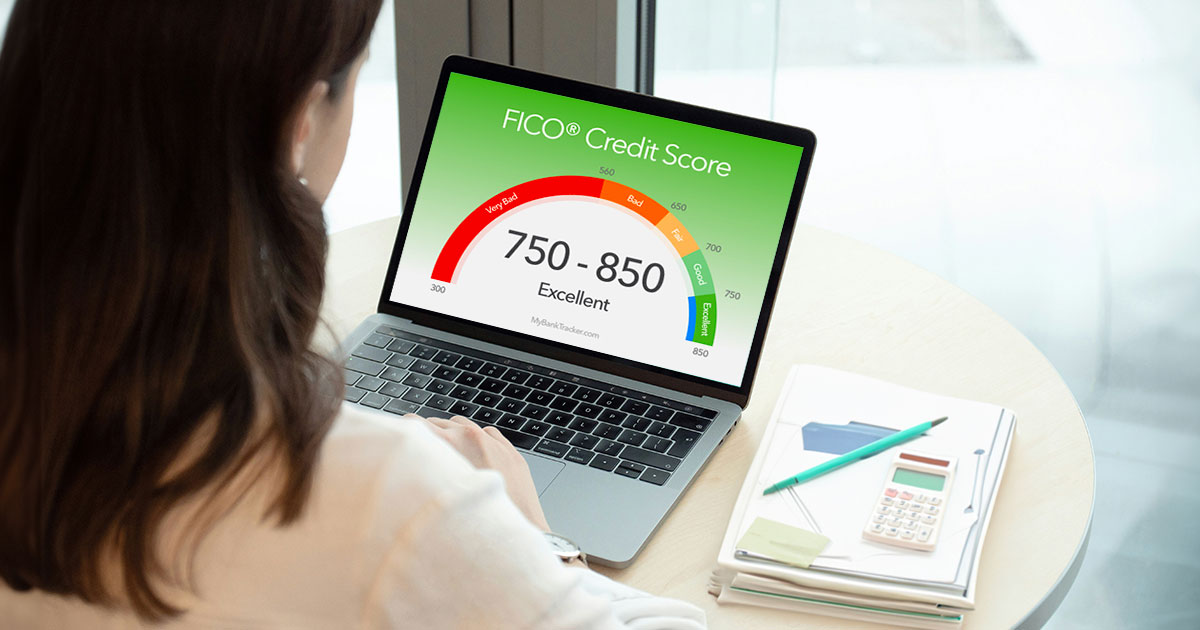

Quick Fixes for Credit Score in 2024

Thus, in 2024 when the finance environment shall have further shifted, accessing a wide deficient of the economic opportunities that go with a high credit score will require a high credit score. Hence, people should embrace the understanding that maintaining a good credit score is important because it will make you to be eligible for better loans terms, lower interest rates and more loan options available for you.

Unveiling the Untold Narrative Behind Credit Scores and Their Real Significance

A credit score is a key part of personal finance that often gets overlooked. This three-digit number takes many parts of your financial life—like how you use credit cards, pay back debts, your loan history, and even how you pay utility bills—and turns it into a very important measure that affects many areas of your life. This number, even if not mentioned, can affect important moments.

How Can You Make the Most of Bad Credit?

So, for instance, let’s sometimes realize the cold and bitter truth that our credit score is not as perfect as we wanted it to be. Players in life’s financial game often know that reverses are inevitable. But there is hope that you will be able to surpass your previous situation and get a better financial situation than before this text to be the end of the story.

Discover the Finest Low APR Credit Cards for 2023

Unveiling this year’s best low APR credit cards gives you the ultimate financial comfort you never imagined before. On the balance sheet, interest expenses are listed under operating activities, which makes it rather easy to reduce them. Review the tiny text saying ‘low APR’ and search for the credit card that would correspond to your patterns of spending and lifestyle.

Selecting the Perfect High Risk Payment Gateway in the USA

For such high-risk enterprises, the option of a secure payment gateway is crucial in a world of high-stake, fast-paced settlement systems. For companies that are associated with elevated levels of risks, there is necessity of high risk payment gateways to ensure secure and easier procedure for payment.