Money market accounts are a dependable option for individuals looking for considerable interest while minimizing risk. If you’re unaware, these accounts, which are available from a variety of financial institutions, offer higher interest rates by investing funds in low-risk, short-term debt-based assets.

Category: Banking

Discover How Online Banking Can Lead to Significant Savings

Bill payments can be a dreadful process, especially if you feel like you’re continually overspending. But what if I told you that by simply changing your payment methods, you could save hundreds of dollars per year?

3 Things You Stand To Gain With a Money Market Account Over a Savings Account

The easy accessibility of a number of overt forms of money market instruments has made most money-centered financial institutions offer money market accounts which can be specialized deposit accounts. They function similarly to ordinary checking and savings accounts, but with one notable difference:

How Many Savings Account You Should Have?

Most people are lucky if they have one bank account and they do not consider the potential advantages that can come from using more than one account. Financial specialists, in contrast, state that it is possible to combine different types of accounts for savings in order to achieve certain savings goals or to coordinate the financial work more effectively.

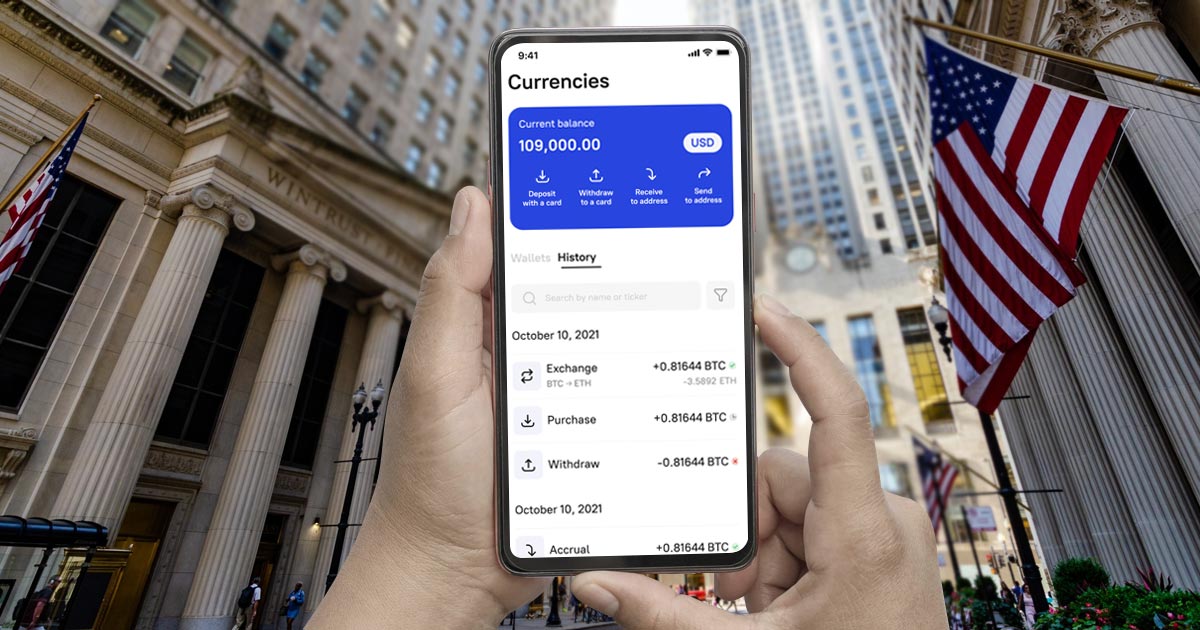

Internet Banking for Dummies

In this day and age, personal finance is a slippery journey. Nonetheless, the knowledge of how your money goes in and out of your account is very important. Thanks to the internet you can do it: online banking.

The Real Costs of Not Having a Bank Account

For instance, the Federal Deposit Insurance Corporation (FDIC) reports that 5.4% of American households did not have a bank account in 2019, which translates to more than 7.1 million families since America has more than 325 million people.

Exploring the Top Bonuses Offered in 2024

Of all the incentives available, getting paid extra for things you were already going to do is still a common option for a lot of people. Financial service providers are always looking to expand their clientele, and one of their favourite ways to do so is by offering bonuses.

Leading Money Transfer Services

Remittance has also become one human activity that is unavoidable in the society as people transfer money to friends and make payments to different merchants. You may find yourself confused and asking yourself as to which of the many money transfer service to select. Point your search in this industry right now in order to identify the key contenders.

How to Avoid Common Bank Fees and Charges

Although it has a fee, banking is an essential tool for managing and protecting your money. The majority of big banks levy a range of costs for checking and savings accounts. Certain expenses, like monthly service fees, are unavoidable, while other payments, like overdraft fees, result from improper account management.

Six Checking Account Bonuses with High New Customer Payouts

This is particularly good knowledge if you are planning on opening a new checking account in the near future, as there could be an opportunity for you to easily make extra cash. Some of the offers common with banks include opening an account with a relatively low balance, maintaining a minimum balance for some period, and enrolling for receiving salary credits direct deposits among other conditions that are usually imposed.